Cra Cryptocurrency Questionnaire

The CRAs Cryptocurrency Tax-Audit Questionnaire. Answering the questionnaire would provide the CRA with a full audit roadmap and a number of admissions against interest.

What To Expect From An Irs Or Cra Crypto Audit Tokentax

The CRA typically begins a cryptocurrency tax audit by issuing a letter notifying the taxpayer about the pending audit the tax years or reporting periods under audit and the general subject matter of the audit.

Cra cryptocurrency questionnaire. The Canada Revenue Agency CRA has sent an extremely detailed questionnaire to citizens it believes to be in possession of cryptocurrency. With some questionnaires it is clear that they have a particular interest in a certain area such as foreign activities but. These letters often include an initial questionnaire.

When CRA audits charities they typically send a long questionnaire to be filled in by the charity on many different issues. The 13-page questionnaire asks Canadians to describe their involvement in the crypto industry over a series of 54 questions. The questionnaire is extensive running 13-pages and poses many detailed questions related to Bitcoin usage.

Big or small fish anyone is bait for a CRA tax review. The CRA typically begins a cryptocurrency tax audit by issuing a letter notifying the taxpayer about the pending audit the tax years or reporting periods under audit and the general subject matter of the audit. The Forbes article links to a copy of what appears to be a CRA document entitled In-Depth Cryptocurrency Initial Interview Questionnaire which has been posted to Scribd.

It appears highly inculpatory. The CRAs Cryptocurrency Tax-Audit Questionnaire. As part of their broader auditing and oversight initiative the CRA has been sending selected taxpayers a 13-page long questionnaire posing 54 questions about cryptocurrency related activities.

Whether the taxpayer trades or mines cryptocurrency. The CRAs Cryptocurrency Tax-Audit Questionnaire. Many of the questions are specifically written to explore potential money laundering.

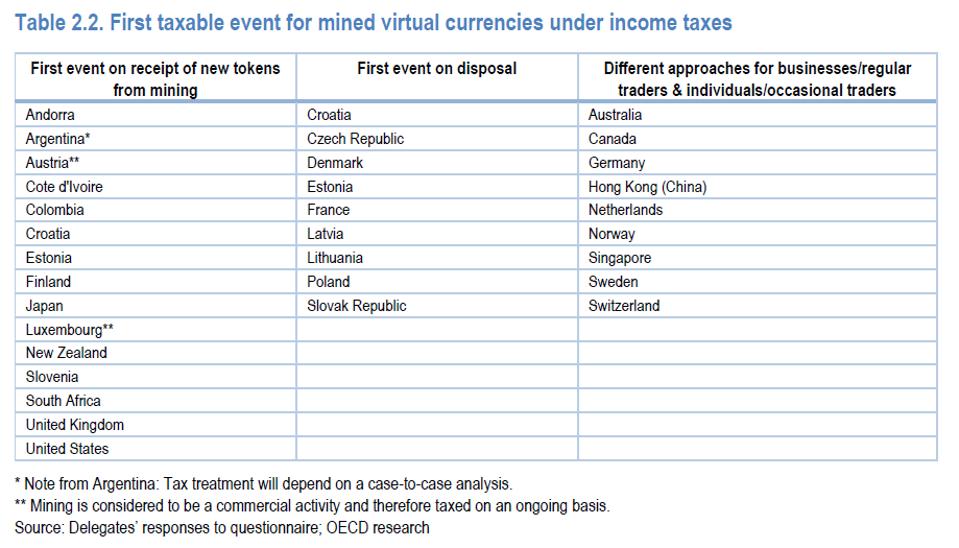

Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. The CRA typically begins a cryptocurrency tax audit by issuing a letter notifying the taxpayer about the pending audit the tax years or reporting periods under audit and the general subject matter of the audit. Guide for cryptocurrency users and tax professionals.

The Canada Revenue Agency the CRA appears to be targeting users of bitcoin and other cryptocurrencies for audit according to a Forbes online article the Article. CRA asking about cryptocurrencies on charity audits. How long the taxpayer has been involved in cryptocurrency.

These questions include queries about. Cryptocurrency Audits and the CRA. Forbes reports the Canada Revenue Agency CRA is auditing cryptocurrency investors by sending them questionnaires.

Moreover the CRA is sending a questionnaire the Questionnaire along with audits requiring taxpayers to describe their bitcoin-related activities. Questions include the following. The Canada Revenue Authority is also now auditing users of bitcoin and other crypto assets as per Forbes.

The CRA has sent a questionnaire in order to understand crypto trading activity. The CRAs cryptocurrency task force has developed a detailed cryptocurrency audit questionnaire designed to identify taxpayers unreported cryptocurrency transactions. As part of their broader auditing and oversight initiative the CRA has been sending selected taxpayers a 13-page long questionnaire posing 54 questions about cryptocurrency related activities.

If selected for a CRA cryptocurrency tax audit Canadian taxpayers receive a 13-page cryptocurrency-audit questionnaire which includes over 50 questions on a range of topics such as. Indeed efforts such as these very likely explain the Canada Revenue Agencys ability to target Canadian residents for cryptocurrency-related tax audits. The CRAs Cryptocurrency Questionnaire.

These questions include queries about. Recently the Canada Revenue Agency has sent out a 13 page questionnaire to those it suspects of owning cryptocurrencies or digital currencies. The timeline of owing or using cryptocurrency.

The questionnaire describes itself as an initial interview and alerts taxpayers that there may be follow up questions. Published August 28 2020 by Mark Blumberg. The CRAs Cryptocurrency Tax-Audit Questionnaire - Monda.

The CRAs cryptocurrency audits follow the example of the Internal Revenue Service who has been actively auditing the cryptocurrency space for several years and which won a partial victory in late 2017 when the United States District Court Northern District of California. How long the taxpayer has been involved in cryptocurrency. These letters often include an initial questionnaire.

These are currencies such as Bitcoin Etherium Litecoin etc. The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with. The CRAs In-Depth Cryptocurrency Initial Interview Questionnaire.

These letters often include an initial questionnaire. Those suspected of failing to disclose the full extent of their holdings have been asked whether they use a cryptocurrency. The CRA typically begins its tax audit process by issuing a letter notifying the taxpayer about the pending audit the tax years or reporting periods under audit and the general subject matter of the audit.

The CRAs Cryptocurrency Questionnaire. Many crypto exchanges are enacting KYC Know Your Customer policies which means they store your government ID and trading history. The difficult issue the CRA faces is the anonymous nature of cryptocurrency transactions which makes it difficult to.

Its tax filing season and while the average Canadian may have already filed their seemingly simple tax returns anyone is bait for a review by the Canadian Revenue Agency CRA according to some experts.

Crypto Bitcoin Business Tax Guide Tax Lawyers In Canada

Bitcoin Investors Targeted With Audits By Canada S Federal Tax Agency

Canada Revenue Agency Auditing Cryptocurrency Investors Feigenbaum Law

Crypto Bitcoin Business Tax Guide Tax Lawyers In Canada

Opinion Cra Being Permitted To Request Cryptocurrency Customers Information Does Not Mean It Is Ideal West Island Blog

Cra Cryptocurrency Compliance And Audits Mlt Aikins Western Canada S Law Firm

The Canadian Revenue Agency Starts To Audit Users Involved In Crypto Trading

Cra Plan For Cryptocurrency Spells Death By Taxation Frontier Centre For Public Policy

Eugene Kem Bcoin All The Latest Bitcoin And Altcoin News

Cra Tax Audit Prosecution For Canadian Crypto Users

Https Www Ecb Europa Eu Pub Conferences Shared Pdf 20171130 Ecb Bdi Conference Payments Conference 2017 Academic Paper Henry Huynh And Nicholls Pdf

Bitcoin Freebitcoin Bitcoin Crypto Currency What Is Bitcoin

Currents Vol Xxiv No 2 2021 By Currents Journal Of International Economic Law Issuu

Anybody Get A Cra Letter Bitcoinca

Crypto Exchange Coinsquare Ordered To Hand Thousands Of Customers Records To Canadian Tax Agency Nasdaq

Unreported Cryptocurrency Is Voluntary Disclosure The Right Option Baker Tilly Canada Chartered Professional Accountants

Cryptocurrency Audits And The Cra

Canada Revenue Agency The Government S Tax Collection Service Is Reportedly Auditing Investors In Crypto Like Bitcoin Mooncatchermeme