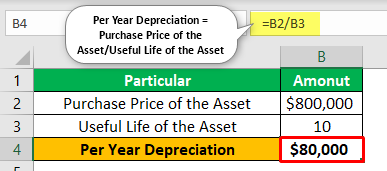

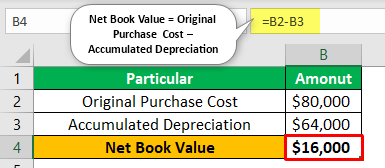

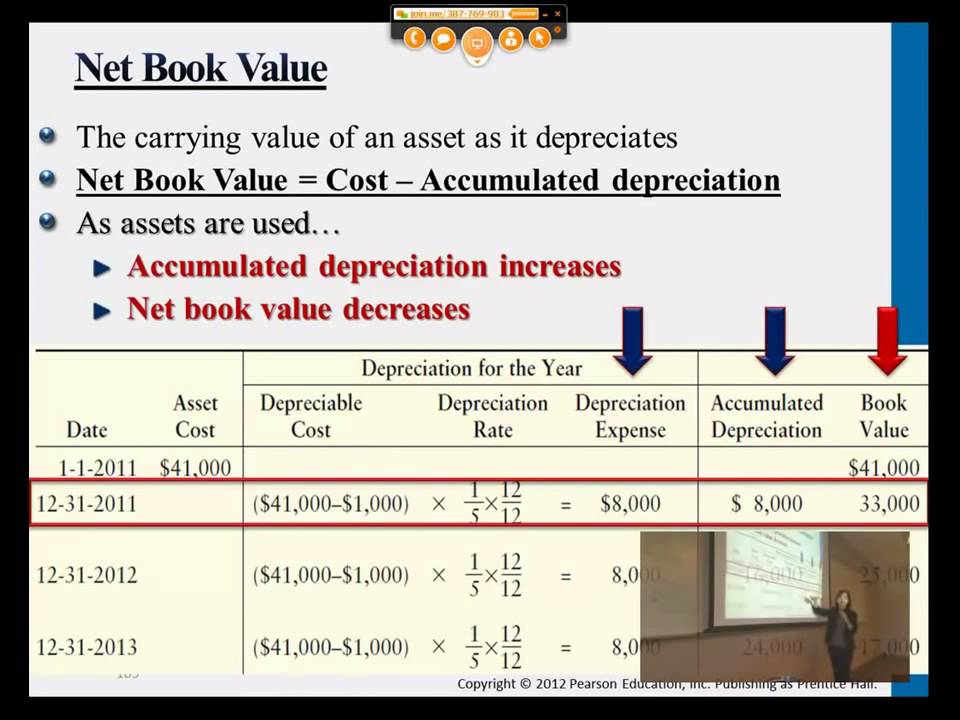

Depreciation net book value formula

Depreciation Rate 20 straight line. It is the balance recorded in its accounting records.

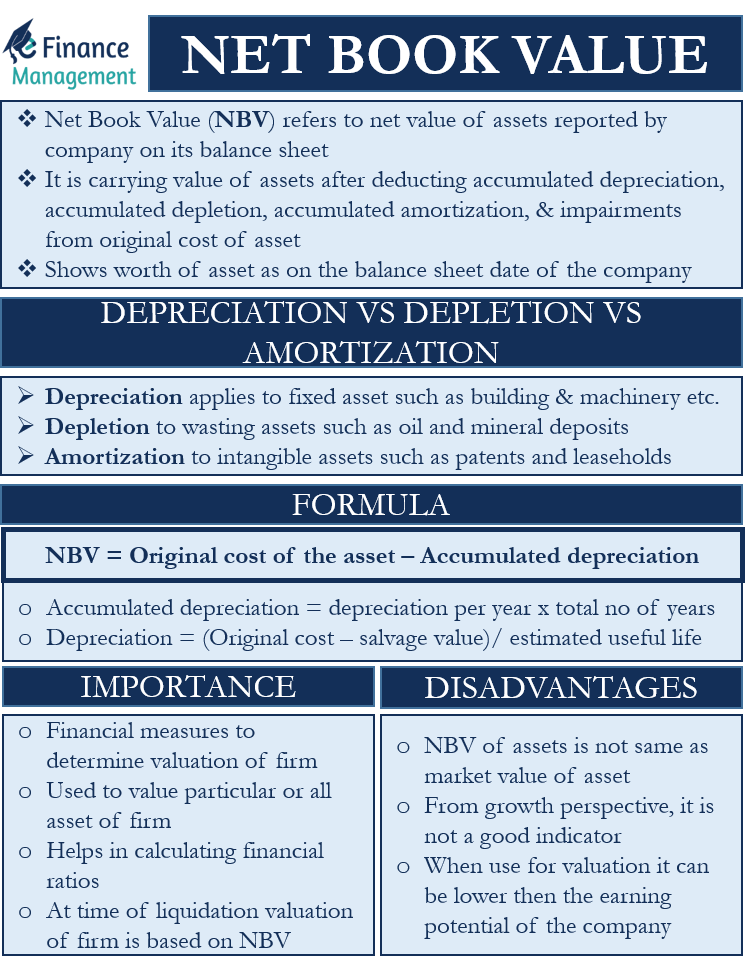

Net Book Value Meaning Formula Calculate Net Book Value

Using the Book Value Equation.

. Journal Entry for Accumulated Depreciation. You can calculate net book value by finding the original cost of the. We have the formula of the double-declining balance depreciation for the fixed assets as below.

And the company uses the straight-line method to depreciate it. The book value of an asset is the value of that asset on the books the accounting books and the balance sheet of a company. To find the book value of an asset the formula can be used.

At the end of the second year company has depreciated this asset for 2 years so the. Book Value of Assets. Net Book Value Adj PDP - Limiting Value Revised useful life Years Depreciated New.

Accumulated depreciation is the total. So if you have an asset. The desks net book value is 8000 15000 purchase price 7000 accumulated depreciation.

Net Book Value Original Asset Cost Accumulated Depreciation. For example ABC Trucking Company buys a semi truck for 100000 and depreciates it by 7000 per year for five years. Depreciation Expense 450005 9000 per years.

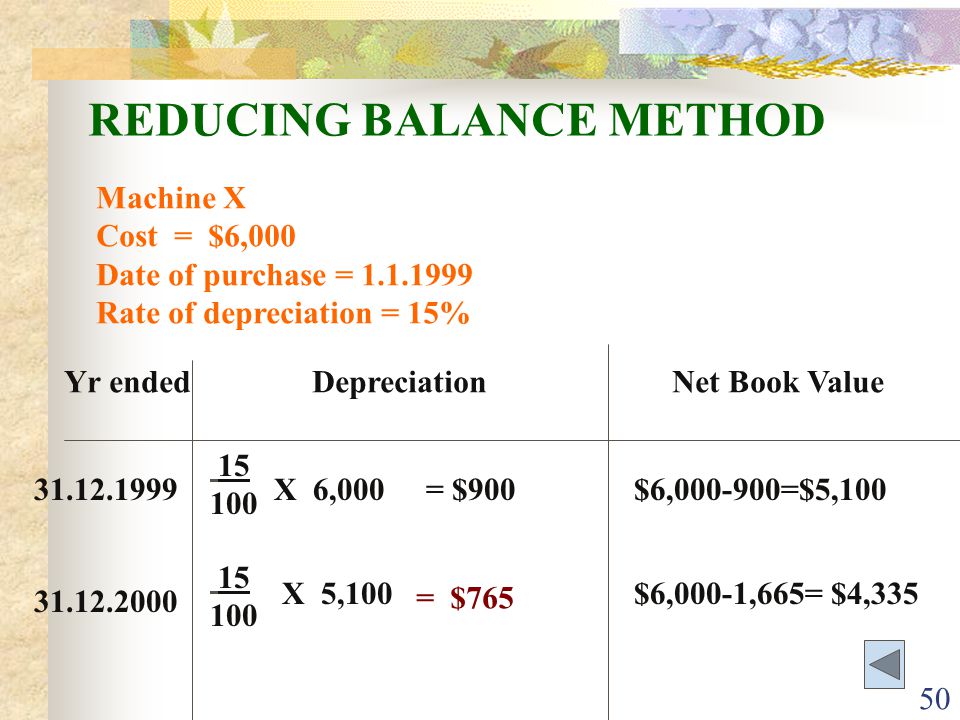

Bookkeeping Taxes Payroll More. Ad No Financial Knowledge Required. You can create a diminishing value method to calculate tax depreciation using a reduced rate in the initial period year of acquisition.

Net book value is the cost of an asset minus accumulated depreciation and accumulated impairment. Ad Serving Small Businesses. Trusted by 130000 companies and 1400 investors.

Scrap Value of Assets. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Book An Appointment Today.

Double declining balance depreciation Net book value x Depreciation rate. 5 Accredited Valuation Methods and PDF Report. The book value of an asset is its historical cost net of any impairments.

1 Its also known as the net book value. This is the amount that was originally paid for the asset. Net book value is an important.

The net book value of the machinery as on December 31 st 2019 is 60000. How Is Net Book Value Calculated. Net Book Value Cost of the Asset - Accumulated Depreciation.

To calculate the net book value for an asset apply the following formula. Accumulated depreciation for 4 years 100000 10000204. Depreciation as per SLM 27000.

The net book value is the book value minus any accumulated depreciation. Considering the example of a computer that was purchased for 800 five. Depreciable value 50000-5000 45000.

Net book value NBV is the value of an asset at which it is recorded on the balance sheet after adjusting for accumulated non-cash charges such as depreciation. How to Calculate Net Book Value. Providing Better Faster Tax Returns For Individuals Businesses.

Using the above net book value. What will be the net book value of the asset after four years of purchase. Net Book Value Analysis.

Net book value or NBV refers to the historical value of your business assets and how they get recorded.

Net Book Value Meaning Formula Calculate Net Book Value

Depreciation Of Fixed Assets Double Entry Bookkeeping

.jpg)

Net Book Value Nbv Definition Meaning Investinganswers

How To Calculate Book Value 13 Steps With Pictures Wikihow

Net Book Value Meaning Formula Calculate Net Book Value

How To Calculate Book Value 13 Steps With Pictures Wikihow

Disposal Of Fixed Assets Journal Entries Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Depreciation Ppt Video Online Download

How To Calculate Book Value 13 Steps With Pictures Wikihow

Net Book Value Professor Victoria Chiu Youtube

Net Book Value Meaning Calculation Example Pros And Cons Efm

Net Book Value Professor Victoria Chiu Youtube

How To Calculate Book Value 13 Steps With Pictures Wikihow

Depreciation And Book Value Calculations Youtube

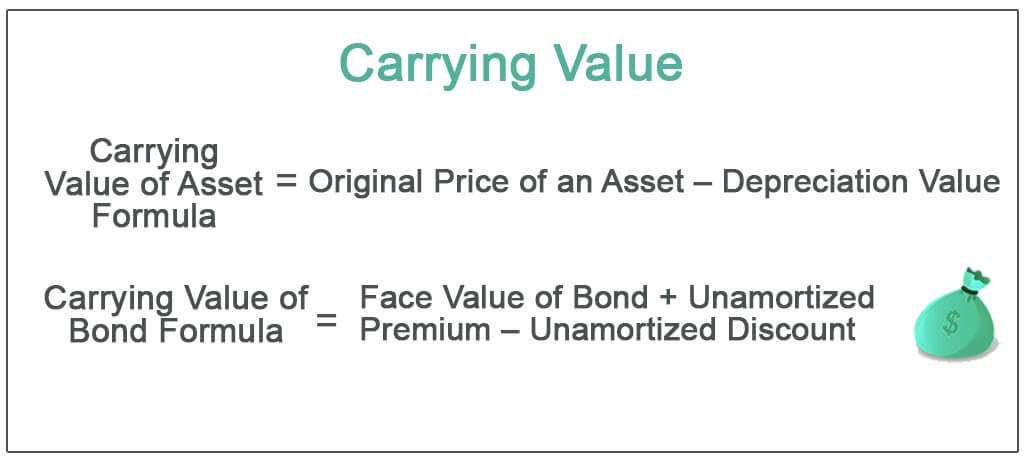

Carrying Value Definition Formula How To Calculate Carrying Value