Capital Gains Tax Rate 2022 Cryptocurrency

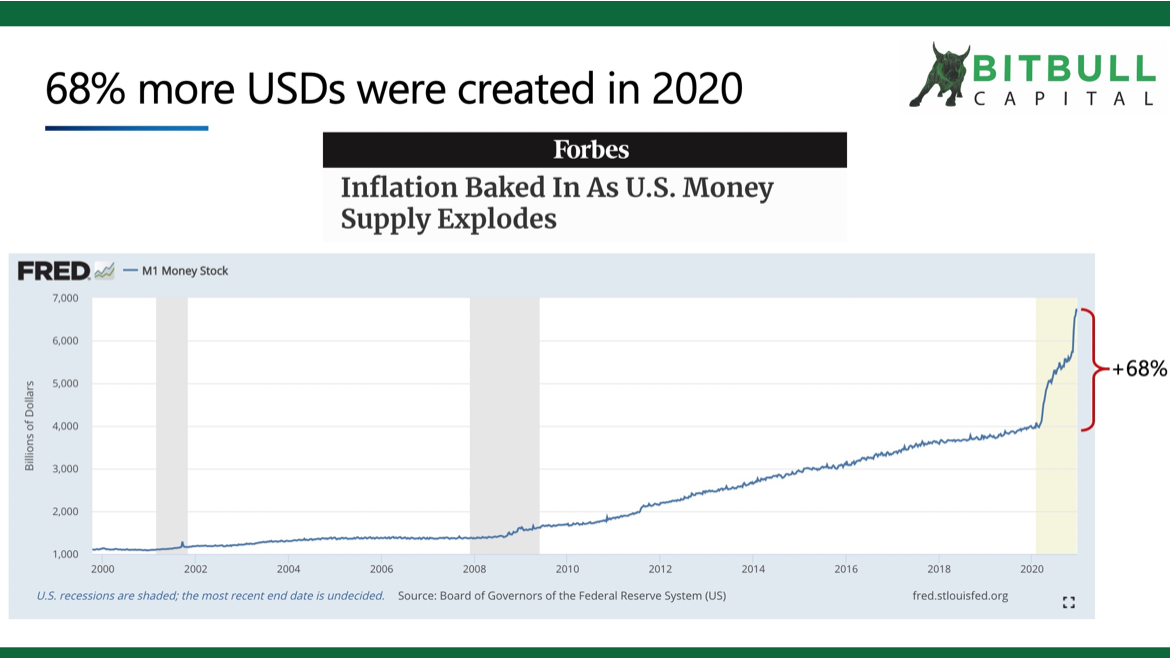

When Am I Subject To The 20 Crypto Capital Gains Tax Rate. On April 28 2021 the Biden Administration released its FY 2022 revenue proposals.

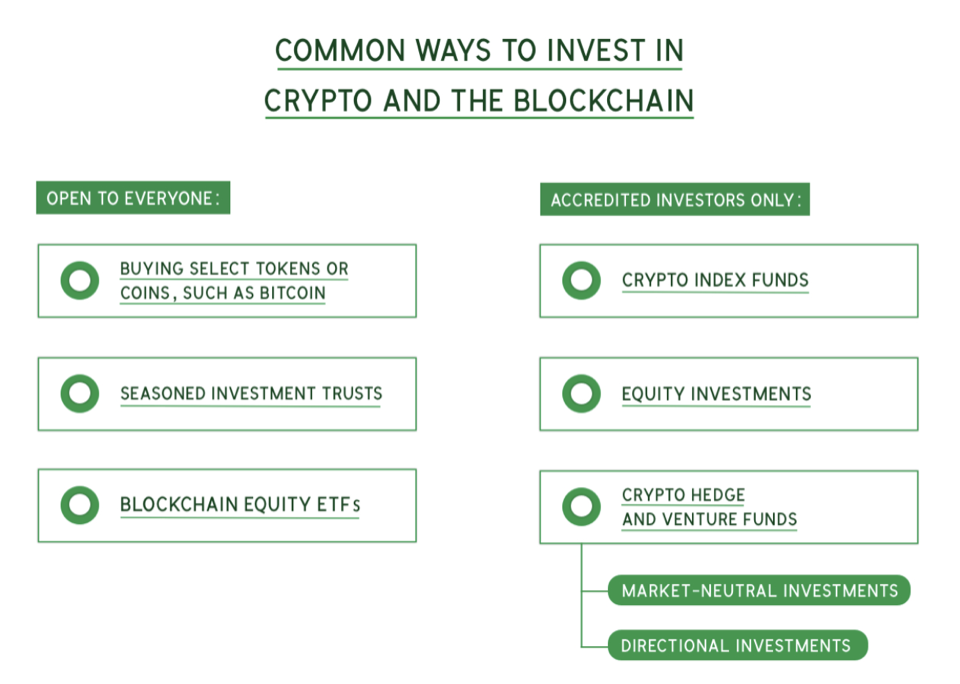

Top 9 Questions About Investing In Bitcoin Blockchain And Cryptocurrencies

The cryptocurrency tax rate for federal taxes is the same as the capital gains tax rate.

Capital gains tax rate 2022 cryptocurrency. If we hold an asset for less than one year our crypto gains will be taxed as a short-term capital gain at the same rate as our ordinary income with a range of 10 to 37 percent. Your specific tax rate primarily depends on three factors. 1 Direct tax treatment of cryptocurrencies The direct taxes are corporation tax income tax and capital gains tax.

Capital gains tax CGT breakdown You pay no CGT on the first 12300 that you make You pay 127 at 10 tax rate for the next 1270 of your capital gains You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains. However if your taxable income puts you into the highest tax bracket of 37 your long-term capital gains tax rate increases to 20. As cryptocurrencies continue to pick up steam and encompass the features of regular asset classes governments have likewise imposed taxes on.

Korean Government To Levy Taxes On Bitcoin Capital Gains Starting 2022. Cryptocurrencies are considered assets and or property. The rate you pay depends on your income.

1 The accounting method used for calculating gains. Along with raising the corporate tax rate to 28 and the top individual rate to 396 there are also widespread proposed changes to the capital gains tax rate and estate tax. If you are in the highest income tax bracket your taxes on your long term capital gains will be 20 instead of 37 the highest tax rate for short term gains.

Another potential major blow to crypto holders. South Korea to impose 20 capital gains tax on crypto in 2022 South Koreas finance department on Wednesday announced a new rule imposing a 20 capital gains tax on cryptocurrency transaction gains starting in 2022. In the US crypto-asset gains are calculated using two factors.

You can also offset capital gains with capital losses. Currently there are three tax rates for long-term capital gains 0 15 and 20. The tax treatments outlined in this manual are for tax purposes only.

According to South Koreas amended income tax law cryptocurrency investors will pay 20 percent tax on profits from digital currencies. This scenario means that any gains you have on your cryptocurrency would be taxed at a much higher rate if you make over 1-million per year. However cryptocurrency investors are entitled to a tax deduction for expenses incurred during mining.

President Joe Bidens 2022 budget proposal will raise the top income tax rate up to 396 and double capital gains taxes for investors making over 1 million. Non-sales transfers of crypto asset ownership will also be subject to statutory gift and inheritance tax rates of up to 50. If youre selling your privately held company a key consideration may be closing the transaction before January 1 2022 when new tax increases are likely to take effect.

This tax hike would negatively impact crypto. As you can see holding onto your crypto for more than one year can provide serious tax benefits. In 2021 it ranges from 10-37 for short-term capital gains and 0-20 for long-term capital gains.

Biden proposes increasing the highest long-term capital gains tax rate from 20 to 396 for those making over 1 million. There is an annual CGT exemption which currently stands at 12300 for the. While the presidents tax hike.

President Biden recently announced his plan to double the long-term capital gains tax rate for those at the top from 20 to 40. Bidens proposal to raise the top tax rate on long-term capital gains to 434 up from 238. The IRS can tax crypto winnings as capital gains.

Your capital gain is simply the difference between what your cryptocurrency cost you and how much you sold it for. These rates I am discussing are the 2021 rates. The federal tax rate on cryptocurrency capital gains ranges from 0 to 37.

Almost everyone else enjoys the 15 long-term capital gains tax rate. Please take note. They do not reflect on the treatment of cryptocurrencies for regulatory or other purposes.

Beginning in the 2022 tax year stock and bond investors will be taxed on capital gains that are over 50 million won or 45000. Biden is proposing to increase the highest long-term capital gains tax rate from 20 to 396 for those who make over 1 million dollars of income.

Seoul To Tax 20 On Crypto Gains From 2022 Mining Cost Deductible Pulse By Maeil Business News Korea

Australian Cryptocurrency Tax Guide 2021 Koinly

Australian Cryptocurrency Tax Guide 2021 Koinly

Bitcoin Taxes How Is Cryptocurrency Taxed In 2021 Picnic S Blog

Implications Of Crypto Assets In The Value Added Tax Income Tax And Property Taxes Inter American Center Of Tax Administrations

Crypto Capital Gains Tax In South Korea Sees Majority Support

Hungary Is Halving Taxes On Cryptocurrency Earnings To Boost Its Covid Hit Economy Euronews

South Korea S Crypto Tax Law Coming In 2022 Btcmanager

Virtual Satoshi Monument Goes Up In Kiev Hollywood Is Next Https News Coinpath Io Virtual Satoshi Monument Goes Up In Kiev Ho Virtual City Virtual Hollywood

Top 9 Questions About Investing In Bitcoin Blockchain And Cryptocurrencies

Indonesia Mulls Tax On Crypto Trading

Top 9 Questions About Investing In Bitcoin Blockchain And Cryptocurrencies

Portugal The Most Crypto Friendly Nation In Europe

What Can Tax Administrations Do In The Face Of The Cryptocurrency Boom Inter American Center Of Tax Administrations

An Income Tax Is A Tax That Is Levied On The Income Earned By Working Individuals Most Governments Impose Taxes Income Tax Capital Gains Tax Income Tax Return

Bitcoin Money Laundering Bitcoin Mining Calculator Bitcoin Is Dead Bitcoin To Dollar Sha256 Bitcoi Bitcoin Mining Software Buy Bitcoin Cryptocurrency Trading

5 Best Crypto Coins Under 1 Cent In 2021 Buy Dogecoin Coins Crypto Coin