Arbitrage Pricing Theory And Cryptocurrency

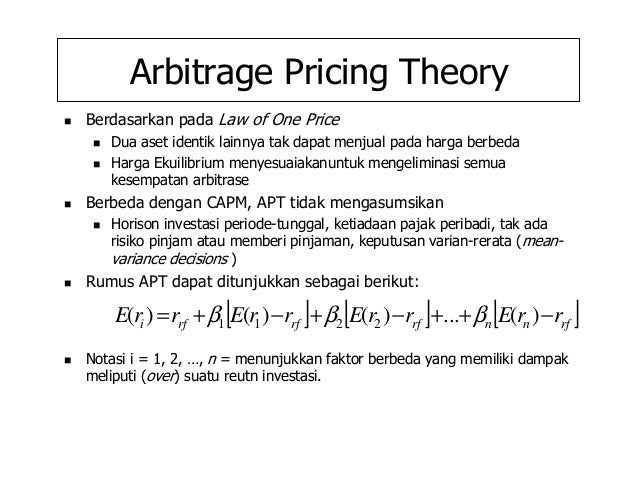

And proposed a new asset pricing model which is the arbitrage pricing theory APT theory. APT involves a process which holds that the asset in question and the returns which are related to it can be pre-determined pretty easily when the relationship that the assents returns have with all the different macroeconomic factors affecting the risk of the asset.

How Does Arbitrage Pricing Theory Work Executium Trading System

It all depends on the specific investment itself.

Arbitrage pricing theory and cryptocurrency. The Arbitrage Pricing Theory is something that can be used for asset pricing. Arbitrage is the profiting from differences in price when the same security trades on two or more markets. The arbitrage is the simultaneous purchase and sale of a coin to profit from an imbalance in the price.

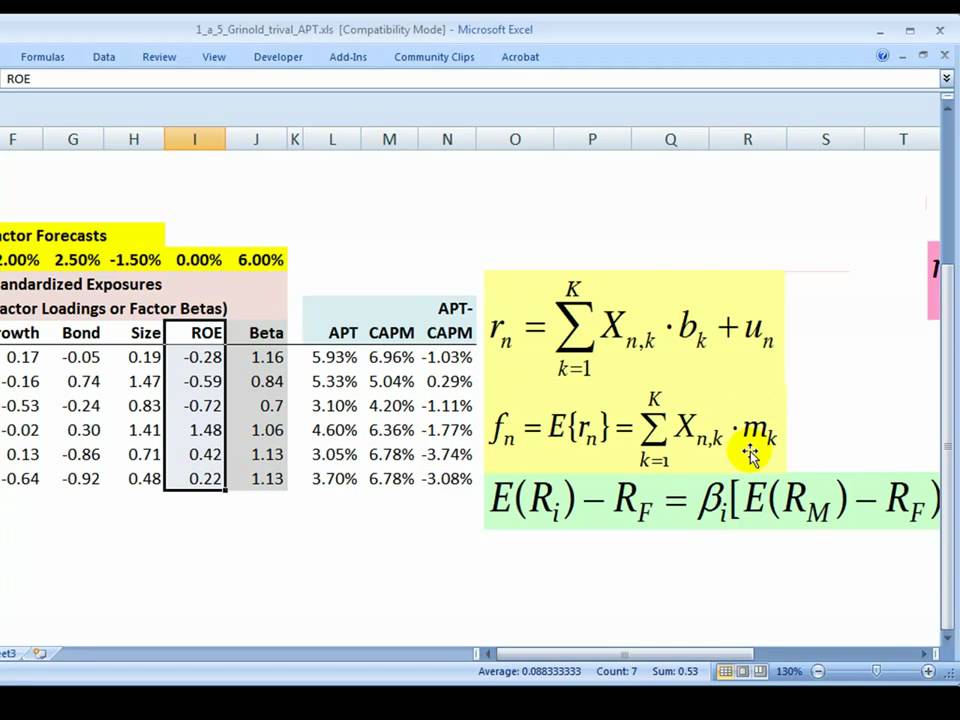

Who Should Use Arbitrage Pricing Theory Arbitrage pricing theory models can be used both by portfolios and by individual instruments. To do so the relationship between the asset and its common risk factors must be analyzed. Then we explain how APT can be implemented step-by-ste.

It was developed by economist Stephen Ross in the 1970s. You trade the Bitcoin for Ripple Ripple for Ethereum and then Ethereum back to Bitcoin. You only have to look out for the inefficiencies across exchanges.

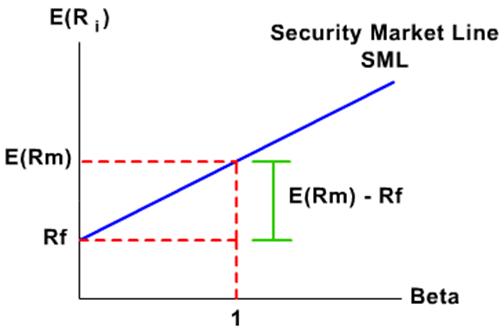

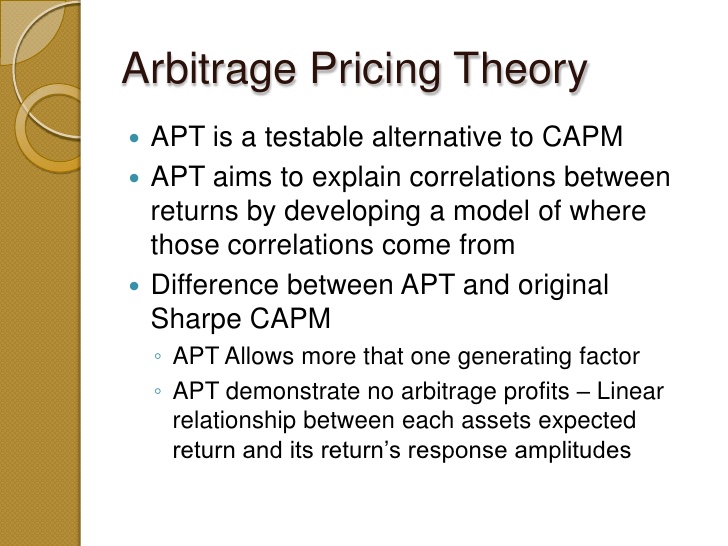

This theory aims at the fact that assets on the market can sometimes be incorrectly priced for a brief period of time. Capital Asset Pricing Risk is inevitable for all types of assets but the risk level for assets can vary. Arbitrage pricing theory APT is an alternative to the capital asset pricing model CAPM for explaining returns of assets or portfolios.

The arbitrage pricing theory or APT is a model of pricing that is based on the concept that an asset can have its returns predicted. Crypto arbitrage helps traders take advantage of the price difference by buying cryptocurrency from one exchange and selling it on another immediately. In 1976 American scholar Stephen Rose published the classic paper Arbitrage Theory of Capital Asset Pricing in the Journal of Economic Theory.

Arbitrage Price Theory vs. 212 Arbitrage Pricing Model APT is a general theory of asset pricing that holds that the expected return of a financial asset can be modeled as a linear function of various macro-economic factors or theoretical market indices where sensitivity to changes in each factor is. APT was first created by Stephen Ross in 1976 to examine the influence of macroeconomic factors.

Ross developed a related theory called the Arbitrage Pricing Theory to counter these weaknesses and to provide a better indicator of investment in assets. So that means you do not have to be a bulk or huge investor to benefit from this theory even a small investor who just invests in one medium say cryptocurrency can apply the knowledge of arbitrage pricing theory and make profits from his. We compare the two theories in this paper and analyze how the arbitrage pricing theory is better than the modern portfolio theory.

Like many other models that are used in cryptocurrency this theory too has been picked up from general financial trading principles and was developed by famous economist Stephen Ross in the 1970s. The simple arbitrage opportunity doesnt need any special knowledge or tools. With this in mind we can now remember that the arbitrage pricing theory is basically a theory of asset pricing developed from the relationship between a securitys expected return and its risks.

It is a combination of trades that profit by exploiting the price difference of the identical trading pair between two or more crypto exchanges. We start by describing arbitrage pricing theory APT and the assumptions on which the model is built. Arbitrage Pricing Theory is a popular one in cryptocurrency and it is good to understand the concept before we move into how it works.

Fortunately even though no one can truly determine risk in an unpredictable market there are ways to calculate the level of risk that comes naturally with a particular. Cryptocurrency trading is quite difficult and there are several risks involved mainly due to the volatility of the crypto market. Also Arbitrage pricing theory uses the concept of arbitrage to define equilibrium does not require the existence of market portfolios and requires fewer assumptions than the capital asset pricing.

Pdf Penggunaan Arbitrage Pricing Theory Untuk Menganalisis Return Saham Syariah

What Is Arbitrage Pricing Theory Executium Trading System

Arbitrage Pricing Theory Powerpoint Presentation Slide Template Templates Powerpoint Presentation Slides Template Ppt Slides Presentation Graphics

Definition Of Arbitrage Pricing Theory India Dictionary

Pdf The Capital Asset Pricing Model And Arbitrage Pricing Theory A Unification

What Is Arbitrage Pricing Theory Capital Com

Capital Asset Pricing Model Capm Pengertian Konsep Dan Kelebihannya Dosen Investor

Capm Vs Apt Capital Asset Pricing Model Beta Finance

Arbitrage Pricing Theory Or Apt Capital Asset Pricing Model Arbitrage

What Is Arbitrage Pricing Theory Executium Trading System

How Does Arbitrage Pricing Theory Work Executium Trading System

The Comparison Between Capm Apt India Dictionary

What Is Arbitrage Pricing Theory Executium Trading System

What Is Arbitrage Pricing Theory Executium Trading System

What Is Arbitrage Pricing Theory Executium Trading System

Arbitrage Pricing Theory Financial Life Hacks Accounting And Finance Economics Lessons